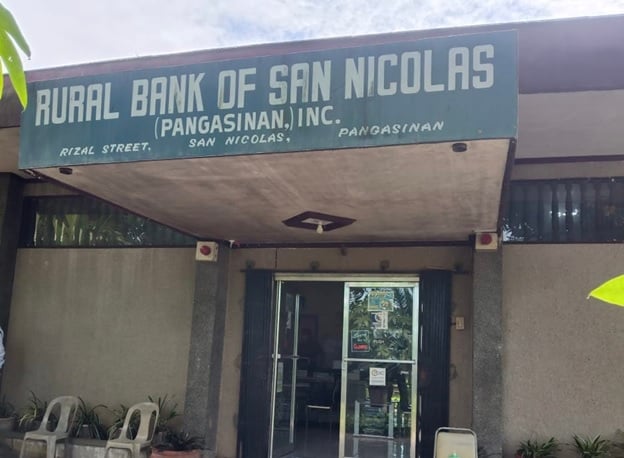

PDIC PHOTO

The Monetary Board (MB) of the Bangko Sentral ng Pilipinas (BSP) shuttered the Rural Bank of San Nicolas (Pangasinan), Inc. and placed it under receivership of state deposit insurer, Philippine Deposit Insurance Corporation.

Through MB Resolution No. 72.B dated January 20, 2022, the PDIC took over the bank on January 21. The MB also directed the PDIC to proceed with the liquidation of the bank.

The PDIC said in a statement that its field personnel complied with Covid-19 health protocols when they took over the bank “for the safety of the bank clients and local residents”

This is the first bank closed by the MB for the year.

According to the PDIC, the Rural Bank of San Nicolas (Pangasinan), Inc. is a single-unit rural bank located in Rizal St., Brgy. Poblacion East, San Nicolas, Pangasinan.

Latest available records show that as of September 30, 2021, the bank has 200 deposit accounts with total deposit liabilities of P8.3 million, of which 89.4% or P7.4 million are insured deposits.

The PDIC assured depositors that all valid deposits and claims will be paid up to the maximum deposit insurance coverage of P500,000.00 per depositor.

The agency added that individual account holders of valid deposits with balances of P100,000.00 and below, who have no outstanding obligations or have not acted as co-makers of obligations with the Rural Bank of San Nicolas (Pangasinan), Inc. are not required to file deposit insurance claims. – Rommel F. Lopez