By John Ezekiel J. Hirro

GCash, the top mobile wallet application in the Philippines, announced on Thursday new features that would allow users to natively shop, save, invest and get insurance coverage.

GLife

The new GLife feature lets users shop within the GCash app, going head-on against e-commerce applications.

Through the GLife feature, users can browse deals from merchants such as GOMO, Gong Cha, Kraver’s, McDonald’s, Puregold and PureGO, Lazada, Recess, Boozy, Bo’s Coffee, Mama Lou’s, GawinPH, KFC, Datablitz, Cherry Shop, Gameone, Goama Games and more, and pay directly with their GCash wallet.

“Accessible right from the GCash dashboard, you can already enjoy more than 25 brands across retail, food, gaming, entertainment and transport. And we have more coming every week that will surely cover all your lifestyle needs,” GCash Chief Customer Officer Winsley Bangit said.

GInvest

GCash users can now use the new investment feature embedded within the app, GInvest.

The feature, made in partnership with ATRAM Trust Corp., lets users invest for as low as P50 in professionally managed local and global funds.

Users can access the investment feature after a risk profile assessment. Investment products include the ATRAM Peso Money Market Fund, ATRAM Global Technology Feeder Fund, ATRAM Global COnsumer Trends Feeder Fund, ATRAM Philippine Equity Smart Index Fund and the ATRAM Total Return Peso Bond Fund.

GInsure

GCash also now comes with a native insurance feature, GInsure, where users can avail themselves of insurance coverage for as low as P300.

Coverage of up to P3.8 million is offered for medical emergencies such as Covid-19, dengue and other accidents, as well as for income loss whatever the cause.

GSave

GSave is GCash’s new savings account feature built in partnership with CIMB Bank that only requires an ID and a smartphone. It has no maintaining balance, fees and initial deposit.

GCredit

Another improved feature is GCredit, which serves as a fully verified user’s personal credit line within the GCash app. It can provide users with high GScores up to P30,000 credit line and up to three percent prorated interest rates.

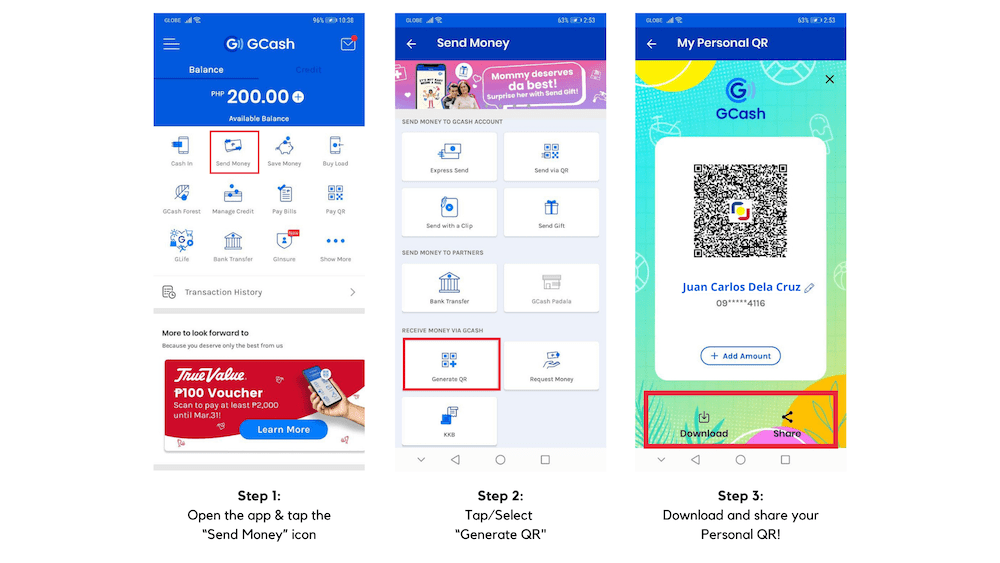

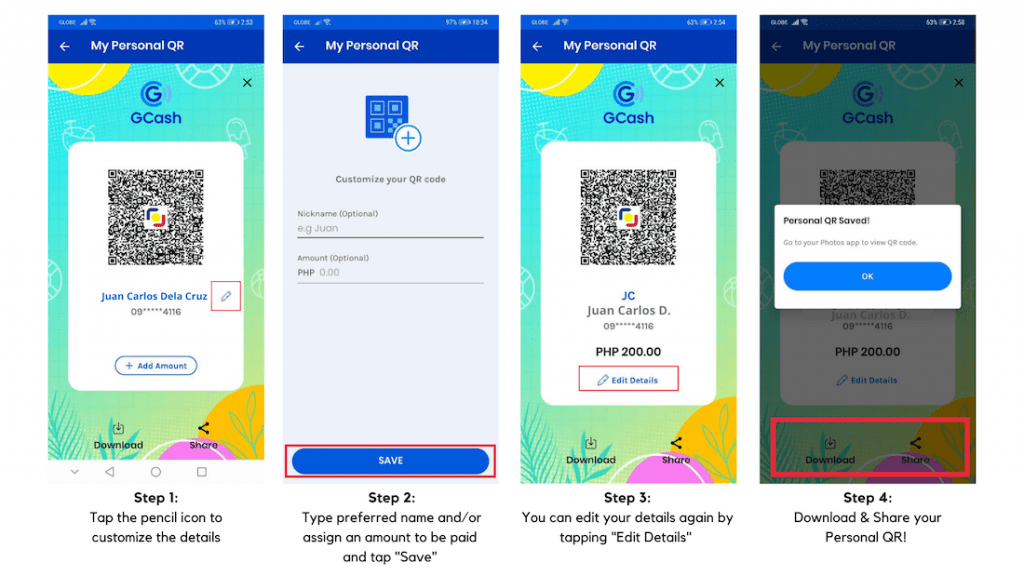

QR on Demand

GCash users may now use QR codes for money transactions, as detailed in the photos below.

Gcash has 40 million users nationwide.

The new features were introduced at the virtual media conference, GCash Futurecast 2021.