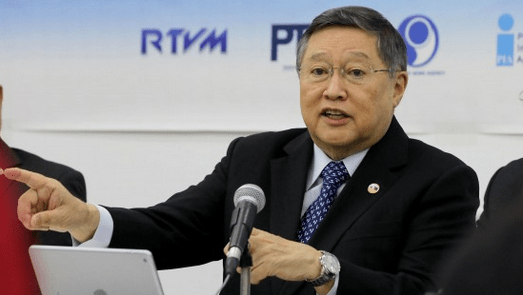

Finance Secretary Carlos Dominguez III (Source: Department of Finance website)

Banks, credit card companies, pawnshops and other lenders must grant a 30-day extension of payments to borrowers for debts falling due within the period of enhanced community quarantine (ECQ), rules released by the Department of Finance on Wednesday stated.

Implementing rules and regulations (IRR) of a provision in the “Bayanihan To Heal As One Act” also state that lenders cannot charge interest or any additional charges and fees on borrowers.

DOWNLOAD: Implementing Rules and Regulations of Section 4(aa) of Republic Act 11469

In a statement, Finance Secretary Carlos Dominguez III said the rules, concerning Section 4 (aa) of the Bayanihan Law or Republic Act (RA) 11469, cover the following:

- banks;

- quasi-banks;

- non-stock savings and loan associations;

- credit card issuers;

- pawnshops;

- other credit granting financial institutions;

- Government Service Insurance System (GSIS);

- Social Security System (SSS); and

- Pag-IBIG Fund.

The IRR states: “All Covered Institutions shall implement a 30-day grace period for all loans with principal and/or interest falling due within the ECQ Period without incurring interest on interest, penalties, fees and other charges. The initial 30-day grace period shall automatically be extended if the ECQ period is extended by the President of the Republic of the Philippines pursuant to his emergency powers under the Bayanihan to Heal as One Act.”

The ECQ period runs from March 17, 2020 to April 12, 2020, based on Proclamation No. 929 issued by President Rodrigo Duterte on March 16, and covers all loans, including multiple loans.

“All Covered Institutions shall not charge or apply interest on interest, fees and charges during the 30-day grace period to future payments/amortizations of the individuals, households, micro, small and medium enterprises (MSMEs) and corporate borrowers,” the IRR states.

Lenders cannot force borrowers waive the application of the provisions of the Bayanihan Law.

The government is waiving additional documentary stamp tax (DST) charges, including for credit extensions and credit restructuring, during the period.

Accrued interest for the 30-day grace period may be paid by the borrower on a staggered basis over the remaining life of the loan.

“Nonetheless, this shall not preclude the borrower from paying the accrued interest in full on the new date following the application of the 30-day grace period or extended grace period, as the case may be,” the IRR states.

Violators will be subject to the penalties under RA 11469, and other laws, rules and regulations.

The IRR also states that the grace period will be automatically extended if the ECQ period is extended by the president. (PressONE.ph)